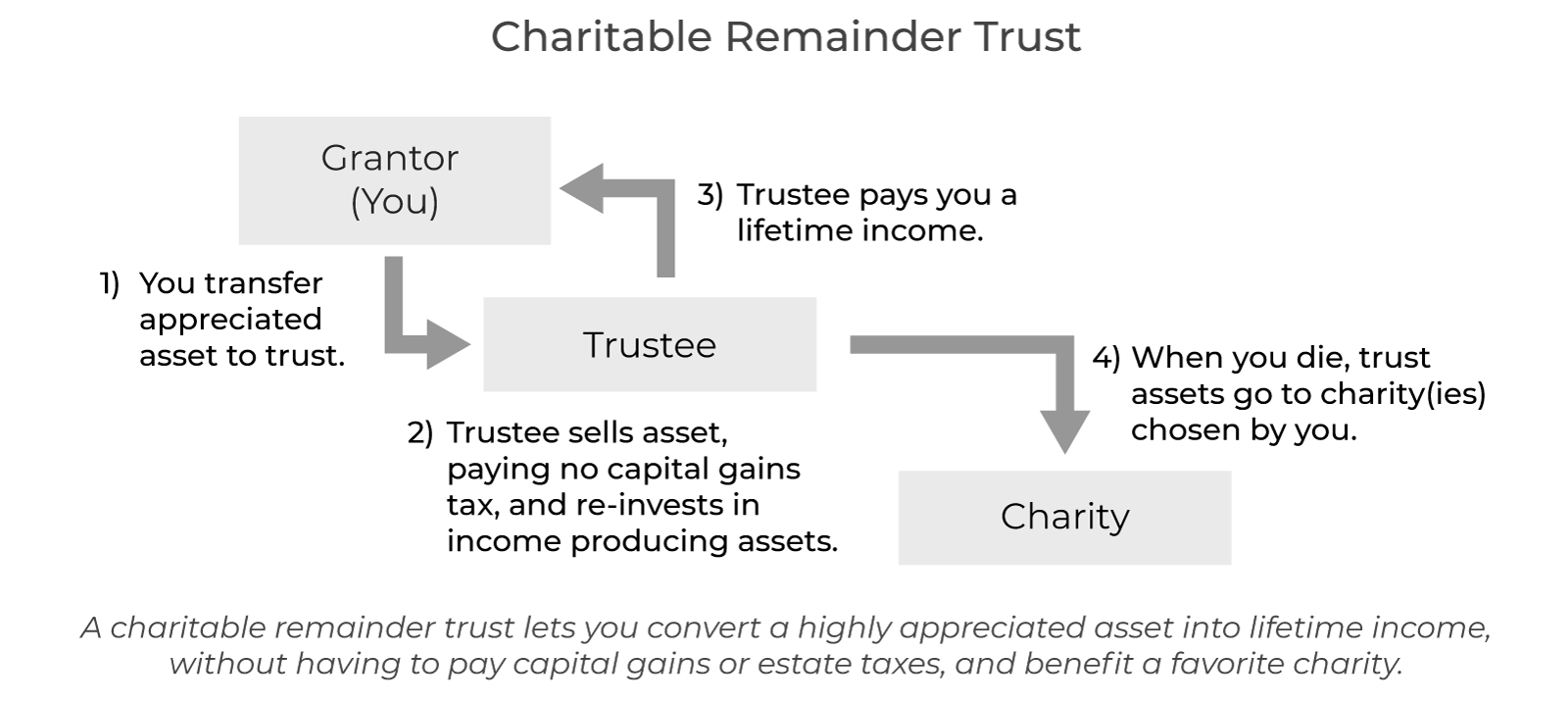

tax benefit rules for trusts

A Health and Education Exclusion Trust HEET can be used to pay for the educational or medical expenses of grandchildren with two primary tax benefits. All of the tax rules for hiring employees apply to resident managers but there are a couple of special rules you need to know about.

4 Unintended Consequences Of Congressional Proposals To Change Ira Investment Rules Millennium Trust Company

Revocable trusts also called living trusts are one of the more.

. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable. Sometimes the settlor can also benefit from the assets in a trust - this is called a settlor-interested trust and has special tax rules. Enter the refund as income then back it out As.

A tax benefit in the prior taxable year from that itemized deduction. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable income in. Trusts can be hugely beneficial for income tax purposes in the right circumstances.

21 hours agoPreviously projects qualifying for the tax credit which can offset up to 70 of an affordable housing projects costs needed to make at least 20 of the units available to. In general the trust must pay income tax on any income its assets generate. Chat With A Trust Will Specialist.

Find out more by reading the information on. In the case of trusts a deduction for amounts set aside for charitable contributions will only be allowed to trusts that are pooled income funds and only with respect to income. It shouldnt but it is not programmed like the 1040.

As long as a trust is not settlor-interested broadly where the settlor or their minor children can benefit. Trusts also benefit from a 50 Capital Gains Tax CGT discount when compared to registered companies. Assets in a revocable trust are included in the grantors gross estate for federal estate tax purposes.

Many estate plans that utilize Jointy. 111 partially codifies the tax benefit rule which generally requires a taxpayer to include. This is available for the disposal of assets held for over 1 year.

Charitable Trusts and NGOs Tax Benefits List. Despite a recent HM Treasury review trusts established to hold excepted group life or relevant life. But if the terms of the trust require it to pay out its income to a beneficiary then the trust itself is.

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. Excepted Group Life Trusts to remain subject to inheritance tax rules.

Trust Tax Rates And Exemptions For 2022 Smartasset

Grantor Trust Strategies To Enact Before The Biden Tax Laws Kick In Financial Planning

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Medicare Trust Fund And How Is It Financed Tax Policy Center

Unexpected Tax Bills For Simple Trusts After Tax Reform

9 Ways To Reduce Your Taxable Income Fidelity Charitable

How Are Trusts Taxed American Academy Of Estate Planning Attorneys

Duties And Responsibilities Of A Trustee

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Taxation Of Special Needs Trusts

The Generation Skipping Transfer Tax A Quick Guide

Income Tax Implications Of Grantor And Non Grantor Trusts Articles Resources Cla Cliftonlarsonallen

Qualified Small Business Stock Qsbs Tax Benefit Carta

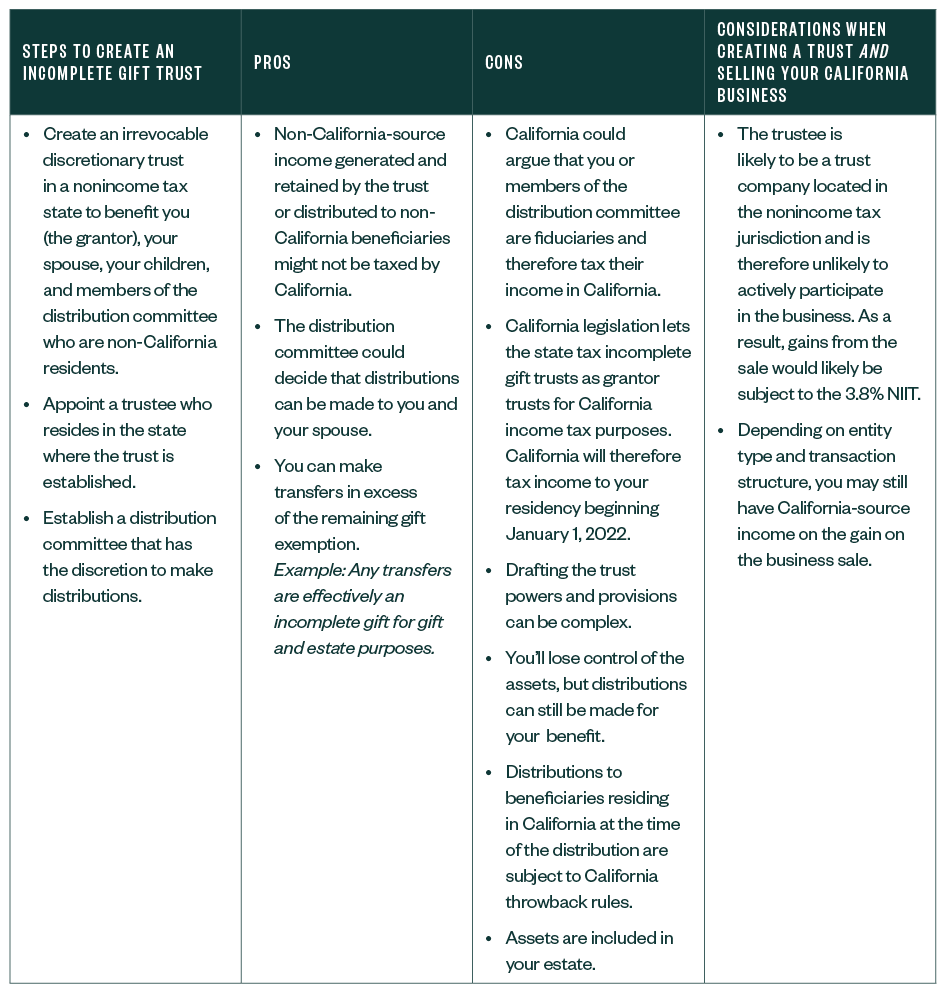

Considerations For Changing Your Residency From California

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Generation Skipping Trust Gst What It Is And How It Works

Secure Act Tax Law Change Undermines Stretch Iras Financial Planning